Contents

Use our follow-up sequence for mortgage brokers and financial service providers to move leads along your sales funnel. We’ve provided templates for you, so all you have to do is download, edit, and send them via WhatsApp, SMS, iMessage, or your favourite messaging app.

Experienced mortgage brokers and financial service providers know that once they’ve sent that initial outreach to a lead, their work to convert that lead into a client has only just begun.

Why? You may already know this, but sales usually don’t happen right after your first outreach! But don’t worry – this is very normal.

Sales don’t usually happen after your first outreach.

However, this also means that you need a good follow-up strategy.

Your plan should go beyond just asking if your client is ready to speak further or buy from you. The follow-up sequence of a seasoned pro helps them stay fresh in their lead’s mind and build a long-term relationship.

What’s more, the information you send to a lead in your follow-ups should also help build their knowledge and confidence in your products and services. This way, they’re not only more likely to want to buy but also see that they should buy from you.

Following up is extremely crucial to landing sales. The good news is that we have a follow-up sequence for mortgage brokers and financial services ready for you!

In fact, all you need to do is copy, personalise that template for you and your business, and send it via WhatsApp, SMS, iMessage, or the popular messaging app of your choice.

Overview

- How to Save Our Intro & Follow-Up Sequence

- Introduction Message

- Follow-Up #1: Check In & Ask for a Meeting

- Follow-Up #2: Check In & Offer Information

- Follow-Up #3: Send Helpful Content

- Follow-Up #4: Thank a Lead for a Call or In-Person Meeting

- Follow-Up #5: Send Relevant Information to the Lead

How to Save Our Intro & Follow-Up Sequence for Mortgage Brokers & Financial Service Providers

From there, you can directly send the follow-up to your clients via WhatsApp, SMS, iMessage, and more. Privyr will even auto-personalise each message with your client’s name. It’s so easy!

With Privyr, you can even track which messages you have sent to a lead, so you can easily decide which template to send next!

Don’t have a Privyr account yet? No worries, we’ve got you! Get started here for free.

Introduction Message for Mortgage Brokers & Financial Advisors

Ideally, you should start with a strong initial outreach message! You can use this one below. We’ve written it to encourage new leads to send you a response, which will help them be more open to your subsequent follow-ups.

Try to send this message within 10 to 15 minutes of receiving your new lead. With Privyr, you can automatically sync new leads from your lead sources straight to your phone, so that you can contact them immediately after they submit their details.

"Hi Eliza, thanks for contacting ACME Mortgage Brokers! I’m Ron, and I’m excited to help you on your mortgage financing journey. You can ask me any questions at any time – I’m here for you!

To start, can you let me know which of these choices sounds most like the mortgage type you’re looking for?

Just send me a number – I’ll send you a brochure based on what you’d like!"

That said, don’t worry if you don’t get a response to this. It usually takes many more messages to engage a lead!

Follow-up #1: Check In & Ask for a Meeting

You can use this message to try and schedule a quick call to get to know your lead better. By suggesting a time, you encourage your lead to reach out with a time that suits their schedule. That can help you get in touch with them faster.

Ideally, you can send this follow up two to three days after you sent your initial outreach.

"Hi Eliza,

Hope everything's going great for you. Mortgage financing can be super confusing, but I’m here to help!

To better understand your needs, how does a call on Thursday at 2PM sound? If that doesn’t work, just let me know a time that works for you!

If you have questions before then, just message them here.

Ron

ACME Mortgage Brokers"

Follow-up #2: Check In & Offer Information

Sometimes your leads may need a little bit more time to consider their options before speaking with you. So, send this message two to three days after your previous follow-up text to offer a general overview of your services.

"Hi Eliza, just wanted to check in on you – how are you feeling about your mortgage financing plans? I’m here to provide you with any information you need.

If it’s alright, I’d love to share a brochure with three of the most common issues our clients face – and how we help solve them.

Just let me know by replying with a Yes or any emoji like

Follow-up #3: Send Helpful Content

Sending information such as brochures along with your follow-up message is a great idea because it accomplishes two tasks with one message.

First, these follow-ups remind them that you’re still there and ready to help if they’re interested.

Second, it’s an easy way to show the value that you add. When your lead sees that you are knowledgeable, they will feel more comfortable engaging with you.

For best results, send these messages only to clients who have replied to your messages at least once.

Below, you can find four options. You can use one or all of them within your sequence. It’s up to you!

Option 1: Send Information about Your Industry

Use this option to send links from external sources, such as a hot or informative news story about the housing market or lending scene.

With Privyr, it’s easy to save, edit, and send this template message with your preferred link to your leads.

"Hi Eliza, in case you haven’t seen ACME News Outlet’s latest story, housing prices in Sydney have climbed 160% in the past 15 years.

http://www.example.com/hotnewsstory

I know that can seem intimidating, but our clients have been dealing with this for the past 15 years, and so have we. We’ve got this!

If you’re looking to move forward with your current mortgage financing journey, or have any questions, please reach out! I’m only a text or call away.

Ron

ACME Mortgage Brokers"

Option 2: Send a Case Study or Customer Story

Let your leads hear from other clients who have found success with you! If you have PDF files with your customer stories or case studies to share, your leads can get more of an understanding of how you’ve helped others.

Then, they’ll see how you can help them too.

Here’s a way to make it even better. Sending content such as PDF files sent through Privyr makes it trackable, which means that you’ll receive an instant alert when your client views it!

This way, even if they’re not responding to you right away – or haven’t messaged you in a long time, you know that they’re still interested in your services. You can use this information to plan your next follow-up.

For example, messaging them within the next day of them viewing your file (not right when they’re looking at it) is a great idea!

Send this template message along with your PDF file in a single, neat message. It’ll look way better than multiple messages, or worse – a file sent without any context!

Just download this template and replace the PDF file with one of your own.

When you send it to clients, they’ll receive an auto-personalised message along with the file. You can copy our message below or create your own!

Hi Eliza,

I hope you’re doing well! We’ve had a number of customer successes lately, and I wanted to share one of their stories with you.

I recently worked with Paul who was a buyer seeking to finance his first home while in between jobs. By working with him over several months, we were able to find a solution that fit. Now, he happily lives in Edenbrook with his wife and puppy Cookie!

Hope you find it insightful!

Ron

ACME Mortgage Brokers

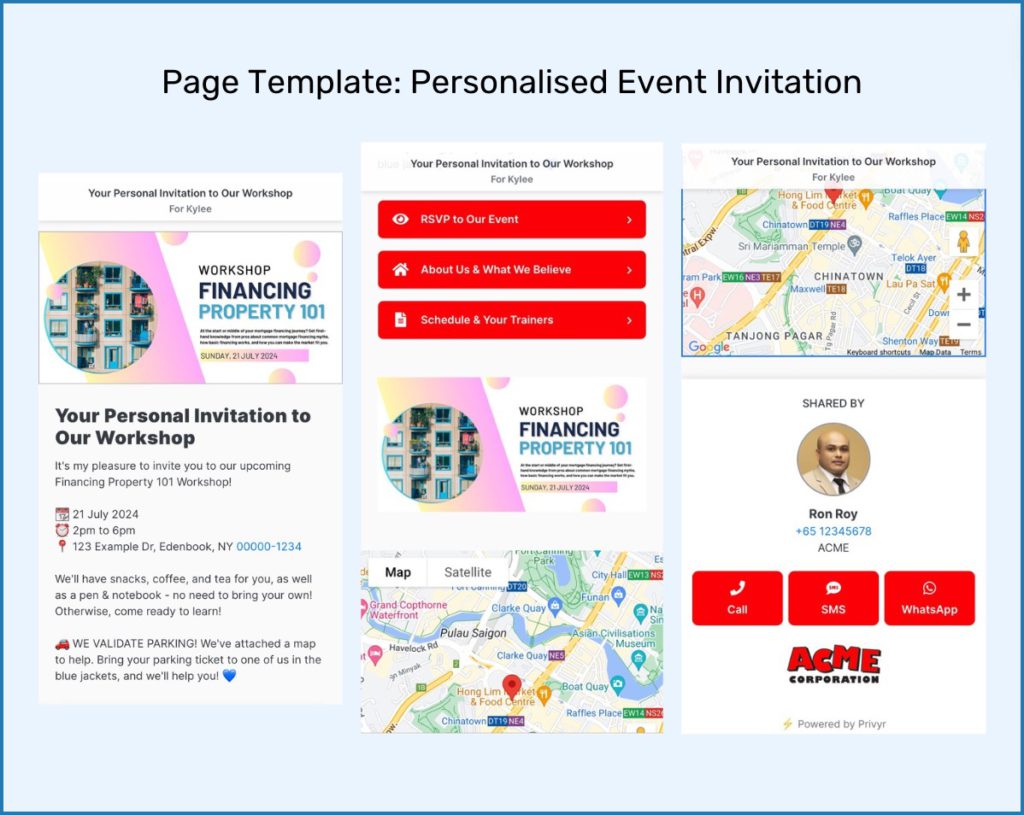

Option 3: Send a Personalised Event Invitation

Events are a great way to educate interested prospects while also getting them excited about your services! Set your event apart from your competitors’ with a personalised invitation – just save the one we share below.

You can edit it with details of your event. Plus, you’ll be able to track who clicks on it, which will give you an idea of who is interested, even if they can’t attend.

Send this template during the lead-up to your event.

For best results, send the link to the invitation with an attached message via WhatsApp, SMS, iMessage, or your favourite messaging app. Here’s one for inspiration:

Hi Eliza, hope everything’s going okay! I want to personally invite you to our Property Financing 101 Workshop. Join aspiring home buyers just like you in a day of learning and community.

You’ll be able to speak with our expert staff and hear from people who have found success with our firm. Hopefully, you’ll walk away feeling more confident about financing options for your home!

Check out our invitation here – just let me know to RSVP.

Ron

ACME Mortgage Brokers

Option 4: Send Information about Your Industry

Send a PDF File to talk about big changes or trends. This way, you’ll let your prospect know that you know your stuff and are available for discussion if they have any concerns.

Here’s a suggestion for the message you can send with your PDF File. In the Privyr app, you can customise an auto-personalised default message to accompany your files when you send them via WhatsApp, SMS, iMessage, and other messaging apps.

Hey Eliza, have you seen the news that property financing laws are changing in the city of Edenbrook?

I know this is an area of interest for you! Just want to let you know that I and everyone else at ACME Mortgage Brokers have been aware of this change coming for months.

All the options we’ve sent to you still work under these new regulations, and we’ve drawn up exactly how that works in the attached file.

If you have any concerns, please text or call me. I’m available to address any questions you may have at this stage in your financing journey.

Ron

Follow-up #4: Thank Your Lead after a Meeting

Even if your lead seemed engaged during a phone call or in-person meeting, it’s a great idea to thank them after.

This way, they have a record in their messages that the meeting took place, and they’ll be able to recall how the meeting went while it is still fresh in their mind. To help, you can add some details about what you talked about.

As time passes, your lead will be less likely to think about buying. So, try to send this thank you message at the end of the day you had the meeting or the next day for best results.

"Hi Eliza,

Thanks so much for meeting with me today! It was a pleasure getting to know more about your home financing journey as well as the adventures you’ve had running your own restaurant. I’ll have to try some of your food sometime.

I think it’s great that you’re interested in bridge loans. Take some time to think about the options I showed you, and let’s discuss soon – I can call you at 2PM on Friday. If that time doesn’t work, just let me know when it’s convenient!

Ron"

Follow-up #5: Send Relevant Information to Your Lead

If a lead remains silent after multiple follow-ups, even if you’ve spoken with them or met them in person, it’s not time to give up yet! This doesn’t mean you’ve lost the sale.

If a lead remains silent after multiple follow-ups, this doesn’t mean you’ve lost the sale!

Your lead could be busy with work or their personal life. Perhaps they’re considering their options or having second thoughts. Don’t worry too much about this.

Instead, concentrate on making sure that when they’re finally ready to take the next step on their financing journey, they remember you – and know where to find you.

To help that happen, you should follow up regularly – even if your lead stays silent for months. While your lead is thinking over their decision, you’ll remain fresh in their minds and high in their recent message history.

In the meantime, you can continue sending content such as industry updates or messages like the one below, which reminds your lead that you’re thinking about them and are available to help.

"Hi Eliza, it’s been a while since I’ve heard from you! Last time we spoke, you mentioned that you were looking into bridge loans while you put your current flat on the market.

I wanted to check in and ask if you managed to find a good fit provider?

If not, I’d love to show you our current findings for bridge loans and other financing opinions – just let me know if you’d like me to send the updated info.

Ron

ACME Mortgage Brokers"

Before you leave, just remember…

Going several weeks or months with no replies from a lead can feel disheartening, but always remember that your lead took the time to fill out your lead form and/or meet with you!

While you may not be able to control what’s going on in their head, you can control how memorable you are and how helpful you appear.

With Privyr, it’s easy to download, save, personalise, and send follow-up messages and other content just like we’ve shown you above!

What’s more, you can schedule automatic reminders and quickly send relevant sales scripts for every touchpoint. Privyr will auto-personalise these messages for your clients on WhatsApp, SMS, text message, and more in just one tap.

Looking to supercharge your team's sales?

Looking to supercharge your team's sales?

Become a Lead Gen Pro

Become a Lead Gen Pro Product Updates

Product Updates